All Services

Our Team

All Services

Services We Provide

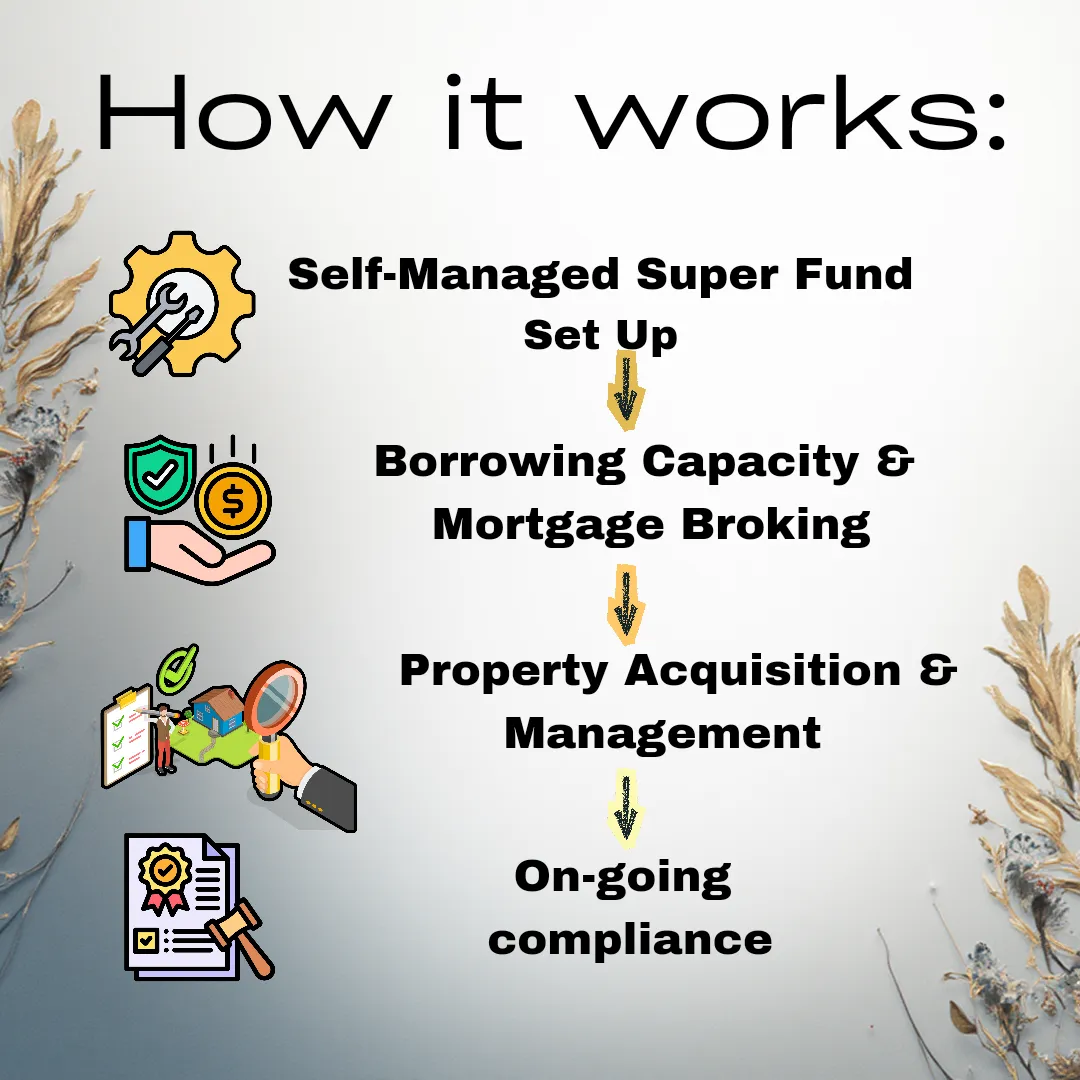

A True End‑to‑End SMSF Property Investment Solution

At SMSF Total Solutions, we provide a fully integrated, end‑to‑end service for clients who want to invest in property through their Self‑Managed Superannuation Fund (SMSF). We support you at every stage of the journey — from setting up your SMSF, to securing finance, acquiring the right property, and ensuring ongoing compliance.

Our approach removes complexity, reduces risk, and gives you confidence that every part of your SMSF property investment is properly structured and professionally managed.

SMSF Setup & Structuring (Accounting Services)

We handle the complete establishment of your fund, including coordinating the preparation of the legal Trust Deed and registering your SMSF with the ATO to ensure a compliant start to your self-managed super journey.

The foundation of a successful SMSF property investment starts with the right structure.

Our accounting team will:

Establish your SMSF in accordance with Australian superannuation laws

Set up trust deeds, trustee structures, and registrations

Register your SMSF with the ATO and obtain an ABN and TFN

Ensure the fund is structured correctly for future property investment

Explain your trustee obligations and compliance responsibilities

We ensure your SMSF is correctly established from day one, so you can invest with confidence and avoid costly mistakes later.

SMSF Borrowing & Mortgage Broking

We provide comprehensive Mortgage Planning, specifically assisting with the setup of the legally required Limited Recourse Borrowing Arrangement (LRBA). This service facilitates your SMSF's ability to secure financing for investment properties or other permitted assets while ensuring full compliance with superannuation laws.

Borrowing through an SMSF is complex and highly regulated. Our mortgage broking service is designed specifically for SMSF property investing.

We will:

Explain the risks, responsibilities, and obligations of borrowing within an SMSF

Assess your SMSF’s borrowing capacity and overall strategy

Structure compliant SMSF lending arrangements (including LRBA considerations)

Source and negotiate suitable SMSF loan products with lenders

Manage the loan application process from start to approval

Our role is to help you understand the risks involved while guiding you through the borrowing process in a compliant and transparent manner.

SMSF Property Strategy, Facilitation & Acquisition

We facilitate the secure and compliant use of your SMSF funds to purchase investment property. we guide SMSF trustees through the entire investment property acquisition process.

Choosing the right property is critical to the success of your SMSF investment.

We work with you to:

Assess your budget and SMSF investment capacity

Identify suitable property options aligned with your SMSF strategy

Help evaluate potential properties based on long‑term suitability and compliance considerations

Coordinate with property professionals to support acquisition and management

Our focus is not just on buying property, but on helping you acquire an asset that fits within your SMSF strategy and financial capability.

On going compliance

Preparation and timely electronic lodgement of the mandatory SMSF Annual Return (SAR) with the ATO, ensuring all tax obligations are met accurately.

Once your SMSF property is acquired, ongoing compliance and reporting are essential.

Our accounting services include:

-Preparation of annual SMSF financial statements

-SMSF tax return preparation and lodgement

-Support with audit coordination

-Ongoing compliance monitoring and reporting

-Assistance with contributions, expenses, and SMSF record‑keeping

We ensure your SMSF remains compliant year after year, giving you peace of mind while your investment works for your future.

Why Choose Us?

With expert financial guidance, personalized solutions, and a commitment to your future, we help you achieve financial security. Our transparent approach ensures trust, while our proven strategies maximize your wealth and stability. Let’s build your financial success together!

01.

Integrated Tax Strategy

Our expertise spans both tax law and superannuation compliance. We structure every investment, contribution, and pension strategy to maximize your retained wealth while minimizing ATO risk and penalties.

We look at your SMSF from a tax-first perspective.

02.

We could tell if you could borrow from lenders

Are you tired of the endless cycle of conversations, paperwork, and confusion that comes with finding the right loan for your home? Look no further. We specialize in bridging the gap between you and your perfect mortgage solution.

03.

Help you find the right property

Unlock the Door to Your Perfect Property

Searching for the right property can be a winding road, but with our insider knowledge and established relationships with top developers, we navigate you straight to your dream destination. Let us leverage our deep industry connections to find you a home that resonates with your vision and needs. Trust in our expertise; we open doors others simply can't.

General Advice Warning

The information contained on this website has been prepared for general information purposes only. It does not constitute, and should not be relied upon as, personal financial advice, taxation advice, legal advice, or investment advice.

Any advice provided is general in nature and has been prepared without taking into account your personal objectives, financial situation, or needs. Before making any financial, investment, taxation, or property-related decision, you should assess whether the information is appropriate to your circumstances and consider obtaining advice from a suitably qualified professional.

While reasonable care has been taken to ensure that the information on this website is accurate and up to date, no representations or warranties are made as to its accuracy, completeness, reliability, or suitability. To the maximum extent permitted by law, we disclaim all liability for any loss or damage arising from reliance on the information contained on this website.

Past performance is not a reliable indicator of future performance.

Contact

Ground Floor, Suite 2, 51-53 Cross Street Guildford NSW 2161, Guildford NSW 2161

0482 080 204

Seamless.Hassle Free. SMSF Property

Business hours:

Mon - Fri : 10AM - 6PM

Weekends: Appointment Basis

© SMSF Total Solutions. 2026. All Rights Reserved.